|

|

|

External Signals:False

Standardfilter: False

|

filter all_trades: |

Bewertung nach 5,10,20,40,60 Tagen (es werden alles Signale verwendet):

| Timestop | count | count per year |

max pos |

return p |

return p day |

return p plus count |

return p minus count |

return p plus |

return p minus |

return r plus |

return r minus |

pf p |

pf r |

tq | return r |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1.0 | 851.0 | 32.77 | 34.0 | 0.099 | 0.099 | 410.0 | 422.0 | 677.5861163802679 | -593.0930515017712 | 65.82510894866681 | -55.002653450367916 | 1.142 | 1.197 | 49.28 | 0.0127 |

| 2.0 | 851.0 | 32.77 | 34.0 | -0.006 | -0.003 | 416.0 | 422.0 | 846.4565988727234 | -851.3387132100072 | 84.73250440009411 | -76.33427092087754 | 0.994 | 1.11 | 49.64 | 0.0099 |

| 3.0 | 851.0 | 32.77 | 34.0 | 0.07 | 0.023 | 448.0 | 392.0 | 1060.6723961866148 | -1001.4352627204539 | 104.59885497805469 | -91.74963338062764 | 1.059 | 1.14 | 53.33 | 0.0151 |

| 4.0 | 851.0 | 32.77 | 34.0 | 0.263 | 0.066 | 457.0 | 387.0 | 1296.7388294267616 | -1073.0057314545697 | 125.66599956976016 | -99.8506945476129 | 1.209 | 1.259 | 54.15 | 0.0303 |

| 5.0 | 851.0 | 32.77 | 34.0 | 0.265 | 0.053 | 452.0 | 388.0 | 1439.5430191691887 | -1213.7727304224306 | 140.98616269705252 | -112.54261179882386 | 1.186 | 1.253 | 53.81 | 0.0334 |

| 7.0 | 851.0 | 32.77 | 34.0 | 0.439 | 0.063 | 465.0 | 380.0 | 1762.6777325162686 | -1389.500862989281 | 170.3359141600706 | -134.53315354614304 | 1.269 | 1.266 | 55.03 | 0.0421 |

| 10.0 | 851.0 | 32.77 | 34.0 | 0.98 | 0.098 | 501.0 | 344.0 | 2337.368085318532 | -1503.5744004583646 | 223.86940866062804 | -149.21661263531902 | 1.555 | 1.5 | 59.29 | 0.0877 |

| 15.0 | 851.0 | 32.77 | 34.0 | 1.219 | 0.081 | 508.0 | 340.0 | 2959.1593455709353 | -1921.4885082266164 | 285.6057167593154 | -186.14162465196665 | 1.54 | 1.534 | 59.91 | 0.1169 |

| 20.0 | 851.0 | 32.77 | 34.0 | 1.459 | 0.073 | 506.0 | 342.0 | 3388.3885377162887 | -2148.387381656049 | 328.21244234388325 | -212.44396042537443 | 1.577 | 1.545 | 59.67 | 0.1362 |

| 30.0 | 851.0 | 32.77 | 34.0 | 2.253 | 0.075 | 520.0 | 326.0 | 4439.760585689366 | -2526.899738454372 | 431.97021766833376 | -245.3884316970687 | 1.757 | 1.76 | 61.47 | 0.2198 |

| 50.0 | 851.0 | 32.77 | 34.0 | 2.772 | 0.055 | 519.0 | 323.0 | 5805.520160498689 | -3465.9801157315414 | 554.0380651985265 | -329.6684283783969 | 1.675 | 1.681 | 61.64 | 0.2658 |

| 100.0 | 851.0 | 32.77 | 34.0 | 5.007 | 0.05 | 504.0 | 327.0 | 8632.057925200581 | -4461.307857716795 | 824.4896350278221 | -433.3522646136066 | 1.935 | 1.903 | 60.65 | 0.4696 |

| 200.0 | 851.0 | 32.77 | 34.0 | 9.637 | 0.048 | 523.0 | 294.0 | 13534.782555332 | -5651.535288000834 | 1310.8429003795263 | -554.2596917965485 | 2.395 | 2.365 | 64.01 | 0.9249 |

entries same day:

| anzahl | |

|---|---|

| anzahl_entries_tag | |

| 2 | 92 |

| 3 | 16 |

| 4 | 3 |

| 6 | 1 |

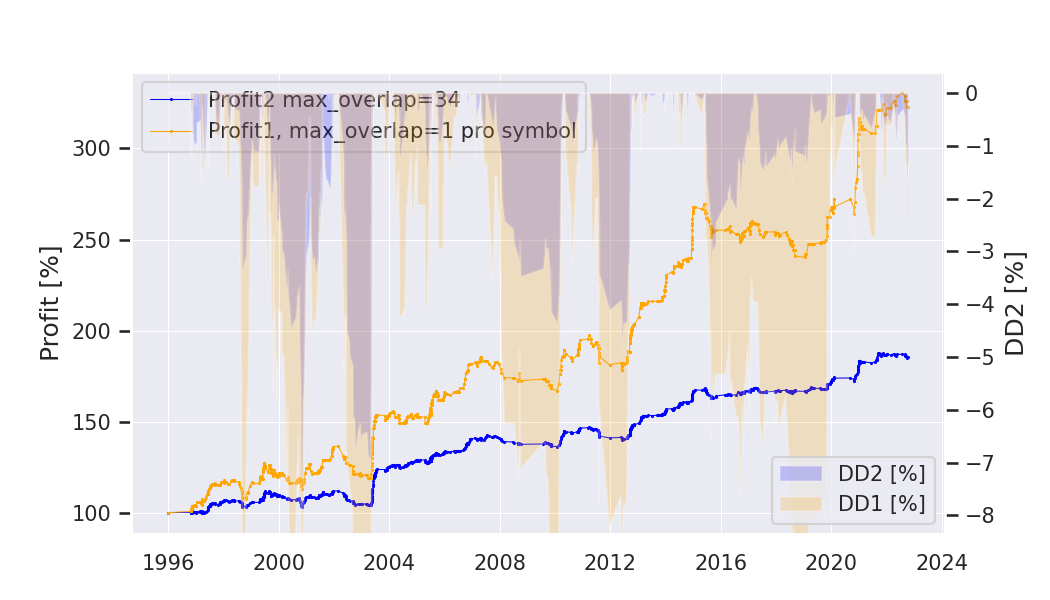

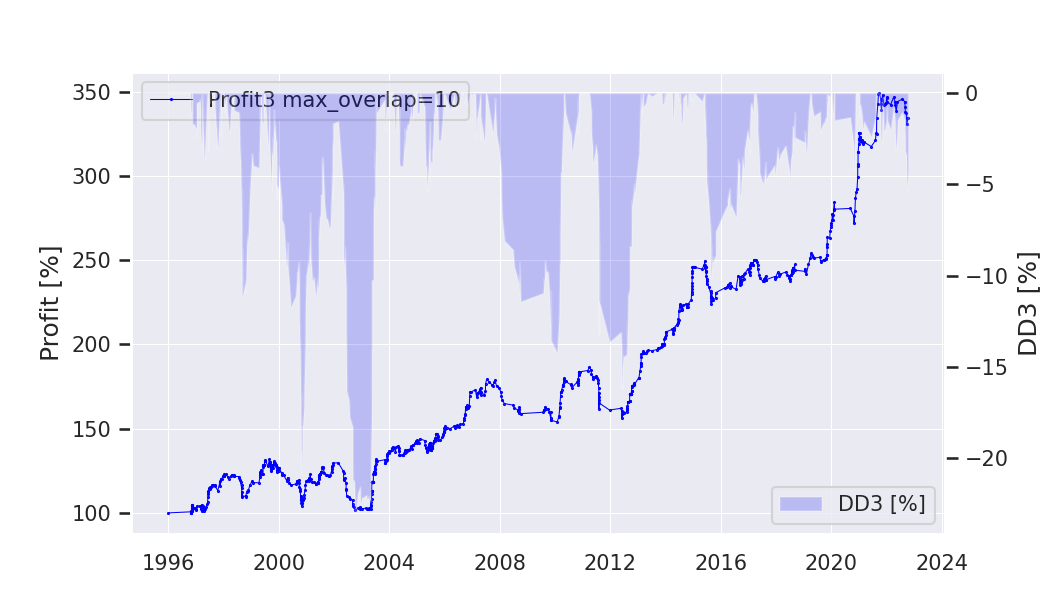

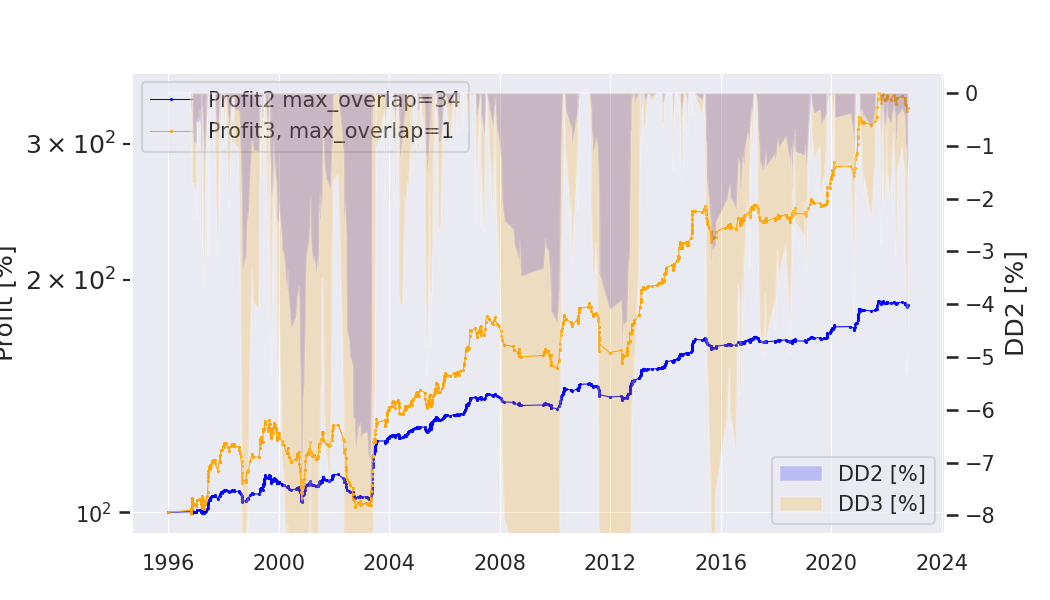

Result: Profit1: mit overlap=1 pro Symbol; Profit2: mit tatsaechlichem overlap gerechnet; Profit3: mit overlap=1 pro Symbol gerechnet

|

|

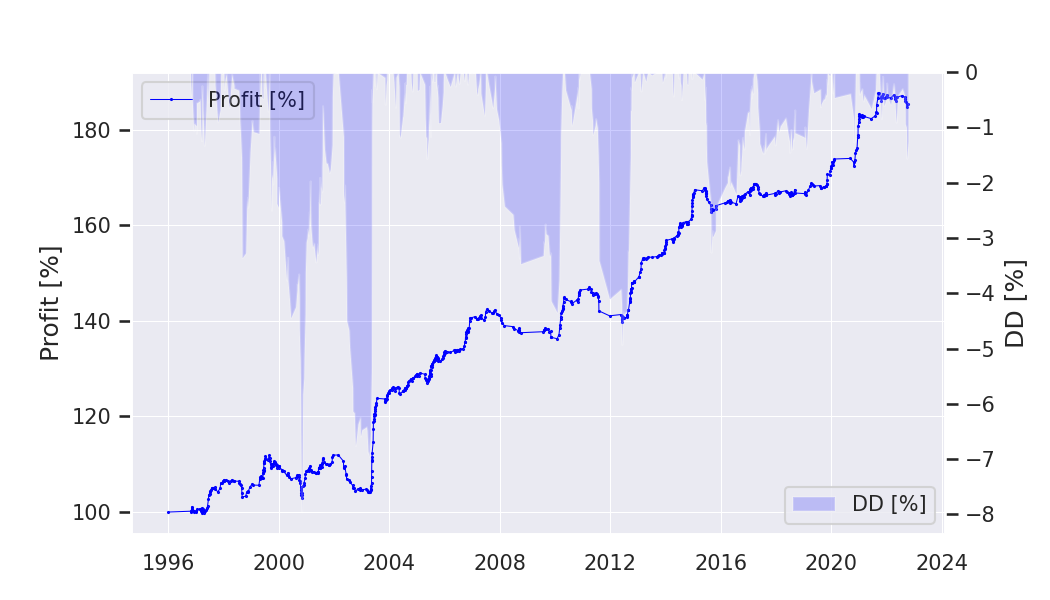

Equity from all_trades (profit2) |

Equity from all_trades (profit2 und profit1) |

Equity from all_trades profit3 |

Equity from all_trades (profit2 und profit3, log) |

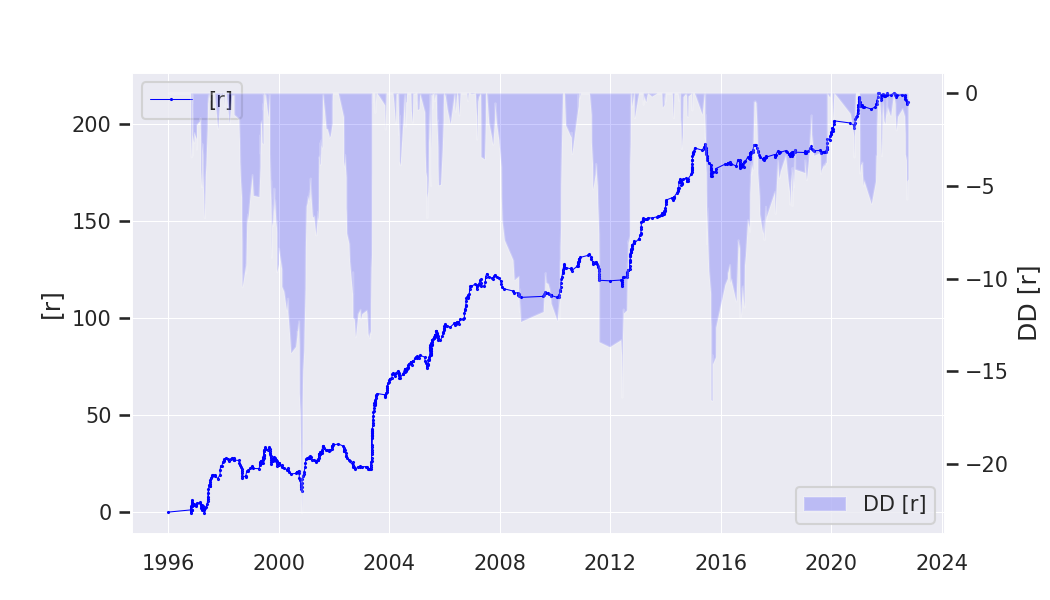

Equity r |

Equity Kurven

Equity Kurven pro Symbol

Equity Kurven pro Strategie

alle Dateien