|

|

|

External Signals:False

Standardfilter: False

|

filter all_trades: |

Bewertung nach 5,10,20,40,60 Tagen (es werden alles Signale verwendet):

| Timestop | count | count per year |

max pos |

return p |

return p day |

return p plus count |

return p minus count |

return p plus |

return p minus |

return r plus |

return r minus |

pf p |

pf r |

tq | return r |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1.0 | 874.0 | 33.56 | 20.0 | 0.139 | 0.139 | 454.0 | 400.0 | 559.4302539879961 | -437.54922440850567 | 77.71936528542469 | -60.35711081285005 | 1.279 | 1.288 | 53.16 | 0.0199 |

| 2.0 | 874.0 | 33.56 | 20.0 | 0.172 | 0.086 | 471.0 | 385.0 | 811.0106800404883 | -660.6743667990278 | 113.63858821990704 | -88.94234285330688 | 1.228 | 1.278 | 55.02 | 0.0283 |

| 3.0 | 874.0 | 33.56 | 20.0 | 0.242 | 0.081 | 470.0 | 390.0 | 989.2906178729427 | -777.6865653764318 | 140.2913955453765 | -108.78946791706272 | 1.272 | 1.29 | 54.65 | 0.036 |

| 4.0 | 874.0 | 33.56 | 20.0 | 0.252 | 0.063 | 468.0 | 398.0 | 1161.7922701271618 | -941.8388247383799 | 161.16131198372707 | -132.4279175150751 | 1.234 | 1.217 | 54.04 | 0.0329 |

| 5.0 | 874.0 | 33.56 | 20.0 | 0.308 | 0.062 | 466.0 | 400.0 | 1281.1325078973623 | -1011.8215624032093 | 179.3438242138098 | -141.97331958744485 | 1.266 | 1.263 | 53.81 | 0.0428 |

| 7.0 | 874.0 | 33.56 | 20.0 | 0.168 | 0.024 | 465.0 | 402.0 | 1516.3768431202102 | -1369.56527933545 | 208.3408848444186 | -189.73944664666334 | 1.107 | 1.098 | 53.63 | 0.0213 |

| 10.0 | 874.0 | 33.56 | 20.0 | 0.374 | 0.037 | 481.0 | 385.0 | 1886.417527864976 | -1560.0790303151553 | 262.0999321080193 | -219.94089037245726 | 1.209 | 1.192 | 55.54 | 0.0483 |

| 15.0 | 874.0 | 33.56 | 20.0 | 0.91 | 0.061 | 503.0 | 365.0 | 2515.9406910939488 | -1722.1520547680113 | 352.2514648174159 | -249.99434586211993 | 1.461 | 1.409 | 57.95 | 0.1173 |

| 20.0 | 874.0 | 33.56 | 20.0 | 1.253 | 0.063 | 519.0 | 350.0 | 3040.4059857153293 | -1949.007607888459 | 430.3121755071283 | -285.19947318712957 | 1.56 | 1.509 | 59.72 | 0.1666 |

| 30.0 | 874.0 | 33.56 | 20.0 | 1.933 | 0.064 | 530.0 | 337.0 | 4039.726970519922 | -2359.5326783768523 | 571.9275488907215 | -351.1913811858651 | 1.712 | 1.629 | 61.13 | 0.254 |

| 50.0 | 874.0 | 33.56 | 20.0 | 2.883 | 0.058 | 533.0 | 325.0 | 5382.872829236574 | -2891.580668873998 | 759.8560273505705 | -408.16151750483493 | 1.862 | 1.862 | 62.12 | 0.4071 |

| 100.0 | 874.0 | 33.56 | 20.0 | 4.633 | 0.046 | 521.0 | 327.0 | 7955.910792992567 | -4027.043948401099 | 1117.386362372211 | -548.5638545307955 | 1.976 | 2.037 | 61.44 | 0.6708 |

| 200.0 | 874.0 | 33.56 | 20.0 | 9.249 | 0.046 | 551.0 | 277.0 | 12728.761316809176 | -5061.536394324378 | 1807.99292767724 | -688.2778631972426 | 2.515 | 2.627 | 66.55 | 1.3507 |

entries same day:

| anzahl | |

|---|---|

| anzahl_entries_tag | |

| 2 | 93 |

| 3 | 14 |

| 4 | 4 |

| 5 | 2 |

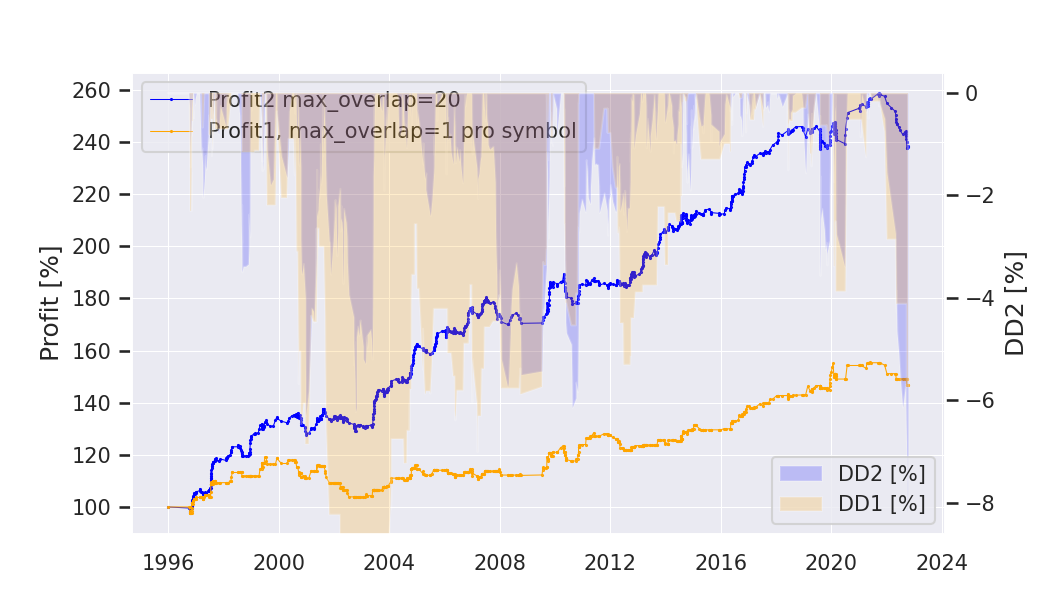

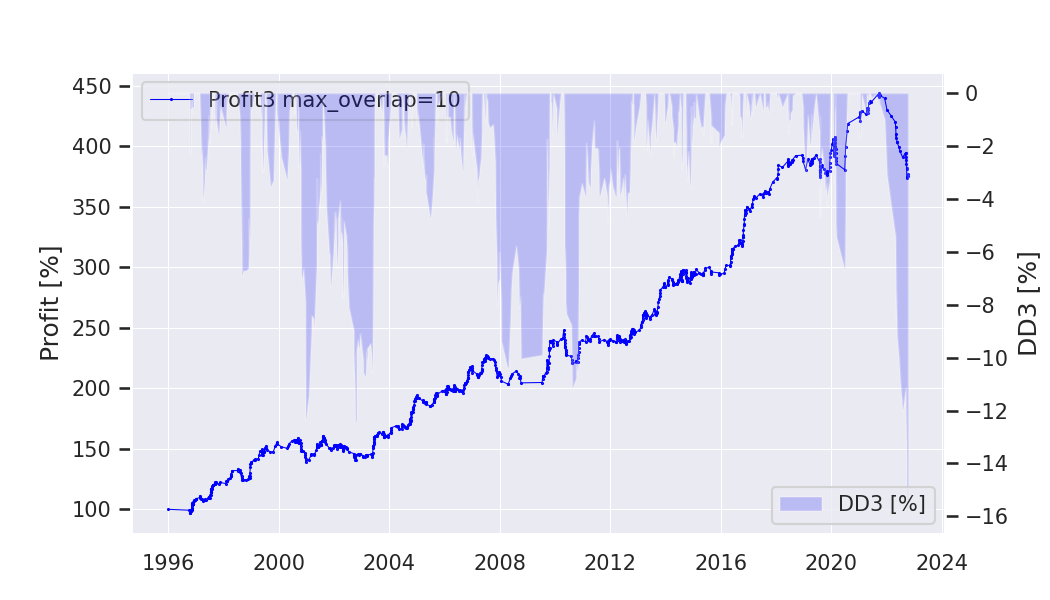

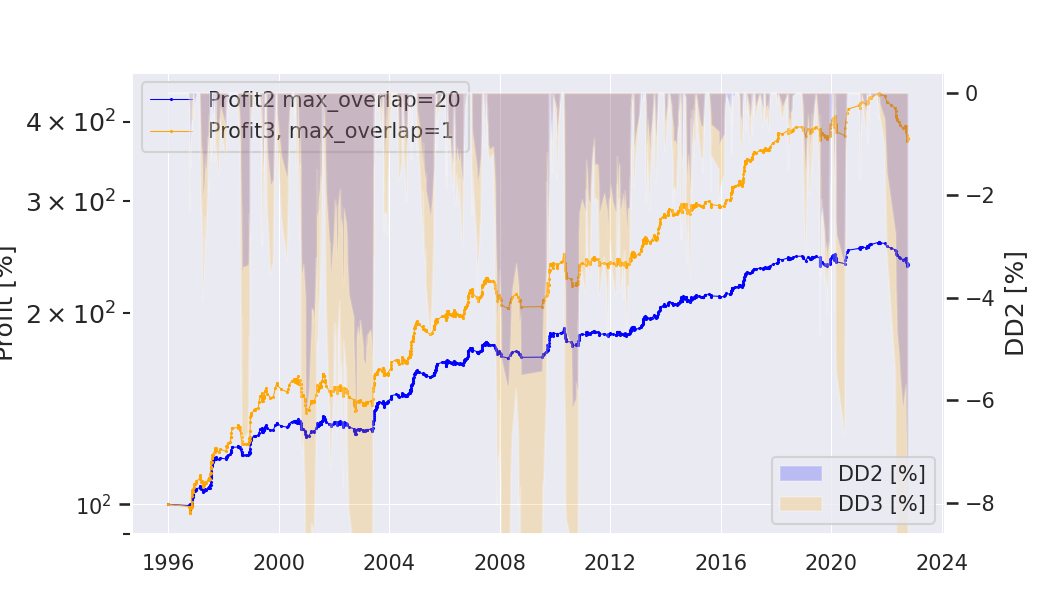

Result: Profit1: mit overlap=1 pro Symbol; Profit2: mit tatsaechlichem overlap gerechnet; Profit3: mit overlap=1 pro Symbol gerechnet

|

|

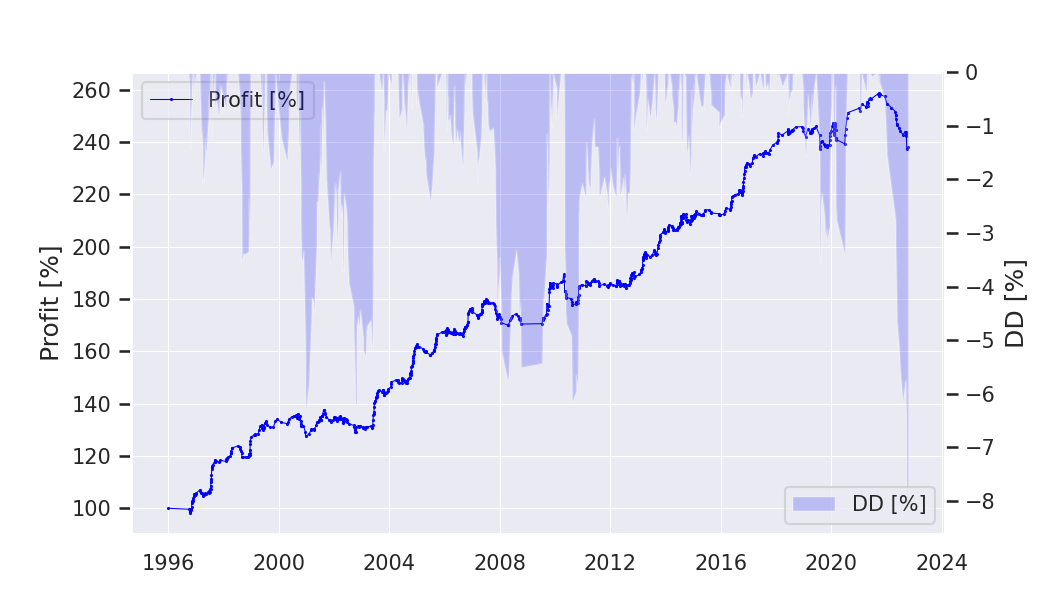

Equity from all_trades (profit2) |

Equity from all_trades (profit2 und profit1) |

Equity from all_trades profit3 |

Equity from all_trades (profit2 und profit3, log) |

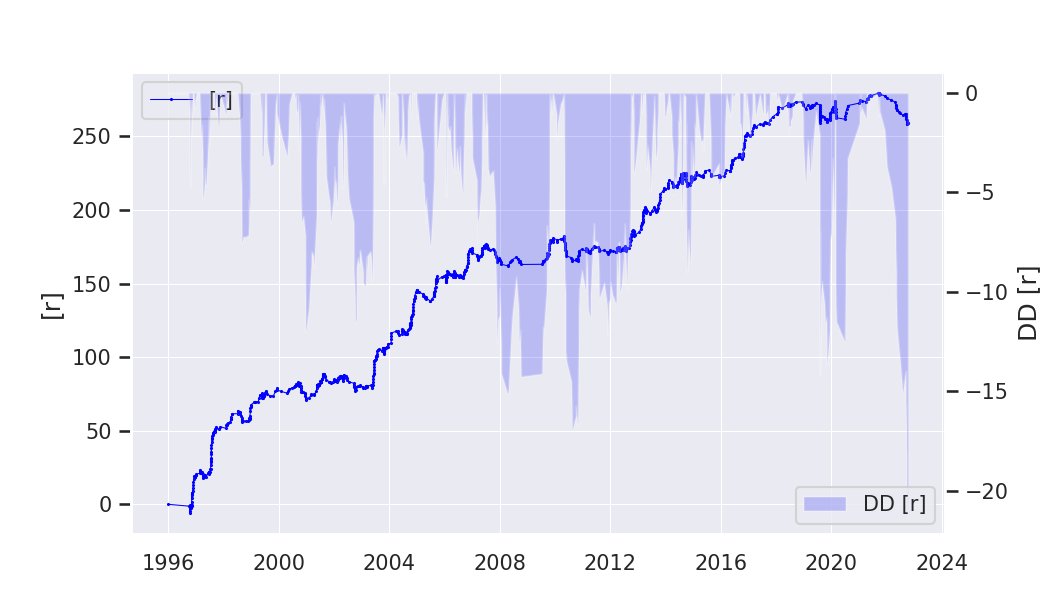

Equity r |

Equity Kurven

Equity Kurven pro Symbol

Equity Kurven pro Strategie

alle Dateien