|

|

|

External Signals:False

Standardfilter: False

|

filter all_trades: |

Bewertung nach 5,10,20,40,60 Tagen (es werden alles Signale verwendet):

| Timestop | count | count per year |

max pos |

return p |

return p day |

return p plus count |

return p minus count |

return p plus |

return p minus |

return r plus |

return r minus |

pf p |

pf r |

tq | return r |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1.0 | 2228.0 | 85.73 | 76.0 | 0.067 | 0.067 | 1159.0 | 1033.0 | 1542.3775384558812 | -1393.5651196154254 | 176.58771179082154 | -150.70175233815914 | 1.107 | 1.172 | 52.87 | 0.0116 |

| 2.0 | 2228.0 | 85.73 | 76.0 | 0.141 | 0.071 | 1166.0 | 1031.0 | 2141.0491559124653 | -1826.8874461765145 | 249.84761824887985 | -203.68862854778797 | 1.172 | 1.227 | 53.07 | 0.0207 |

| 3.0 | 2228.0 | 85.73 | 76.0 | 0.192 | 0.064 | 1202.0 | 1005.0 | 2674.3751245164294 | -2246.396123530345 | 315.4286232384935 | -248.55799822423123 | 1.191 | 1.269 | 54.46 | 0.03 |

| 4.0 | 2228.0 | 85.73 | 76.0 | 0.234 | 0.059 | 1249.0 | 965.0 | 3099.6104145221275 | -2578.075348435139 | 366.51742212417787 | -282.4569503483623 | 1.202 | 1.298 | 56.41 | 0.0377 |

| 5.0 | 2228.0 | 85.73 | 76.0 | 0.322 | 0.064 | 1232.0 | 979.0 | 3509.9724100260883 | -2793.6814596296153 | 415.2994817589538 | -308.5870333615714 | 1.256 | 1.346 | 55.72 | 0.0479 |

| 7.0 | 2228.0 | 85.73 | 76.0 | 0.532 | 0.076 | 1254.0 | 958.0 | 4299.33420296218 | -3114.2552306921516 | 500.57064180378785 | -357.84259193206765 | 1.381 | 1.399 | 56.69 | 0.0641 |

| 10.0 | 2228.0 | 85.73 | 76.0 | 0.752 | 0.075 | 1303.0 | 911.0 | 5294.247579831723 | -3620.949201017622 | 617.2242063152489 | -418.11016911962315 | 1.462 | 1.476 | 58.85 | 0.0894 |

| 15.0 | 2228.0 | 85.73 | 76.0 | 0.99 | 0.066 | 1308.0 | 905.0 | 6625.09159572111 | -4422.802379746121 | 765.3953420310773 | -504.3422608470186 | 1.498 | 1.518 | 59.11 | 0.1173 |

| 20.0 | 2228.0 | 85.73 | 76.0 | 1.386 | 0.069 | 1313.0 | 899.0 | 8104.39649723808 | -5021.016463081317 | 935.0293184223387 | -567.5315848912904 | 1.614 | 1.648 | 59.36 | 0.1652 |

| 30.0 | 2228.0 | 85.73 | 76.0 | 2.014 | 0.067 | 1343.0 | 869.0 | 10521.065955021077 | -6044.693522031938 | 1219.860562942074 | -678.0757344656485 | 1.741 | 1.799 | 60.71 | 0.2437 |

| 50.0 | 2228.0 | 85.73 | 76.0 | 2.818 | 0.056 | 1364.0 | 840.0 | 13813.837936437863 | -7582.733679885632 | 1610.1429832796584 | -837.8964324640515 | 1.822 | 1.922 | 61.89 | 0.3493 |

| 100.0 | 2228.0 | 85.73 | 76.0 | 4.946 | 0.049 | 1385.0 | 792.0 | 21220.098756147923 | -10443.022649410897 | 2524.6661301345525 | -1139.8717218987197 | 2.032 | 2.215 | 63.62 | 0.6355 |

| 200.0 | 2228.0 | 85.73 | 76.0 | 7.774 | 0.039 | 1364.0 | 779.0 | 31263.975619525652 | -14588.113419270063 | 3754.723949257045 | -1564.0172711453856 | 2.143 | 2.401 | 63.65 | 1.0213 |

entries same day:

| anzahl | |

|---|---|

| anzahl_entries_tag | |

| 2 | 291 |

| 3 | 77 |

| 4 | 25 |

| 5 | 11 |

| 6 | 2 |

| 7 | 1 |

| 8 | 2 |

| 9 | 1 |

| 10 | 1 |

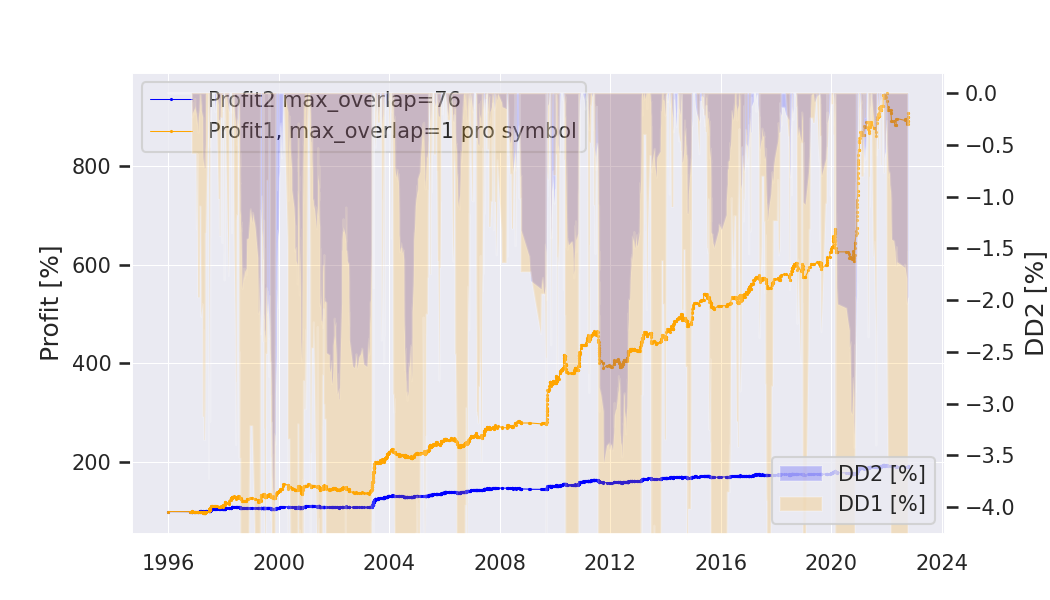

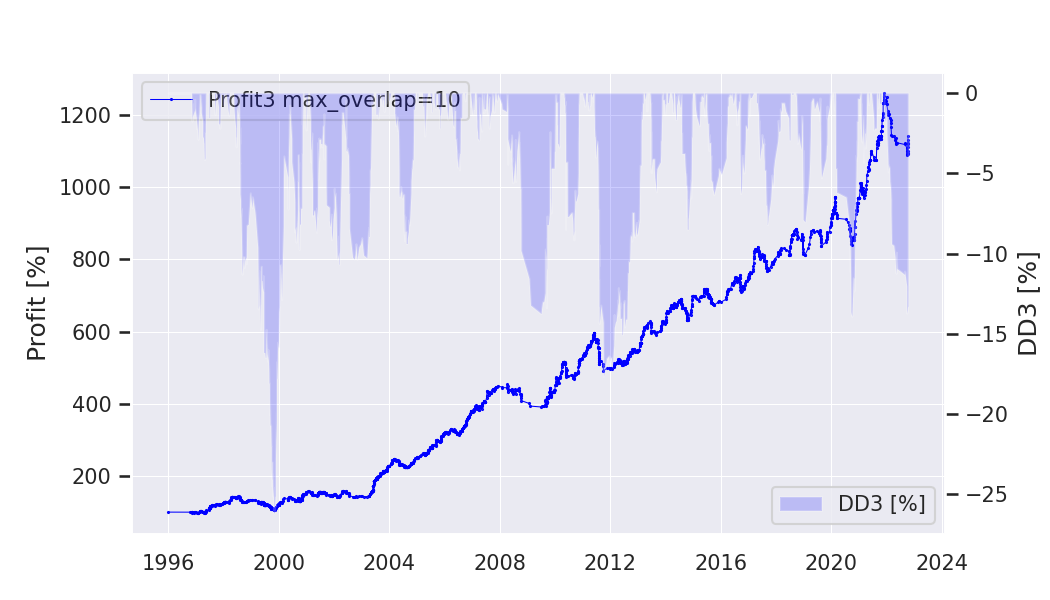

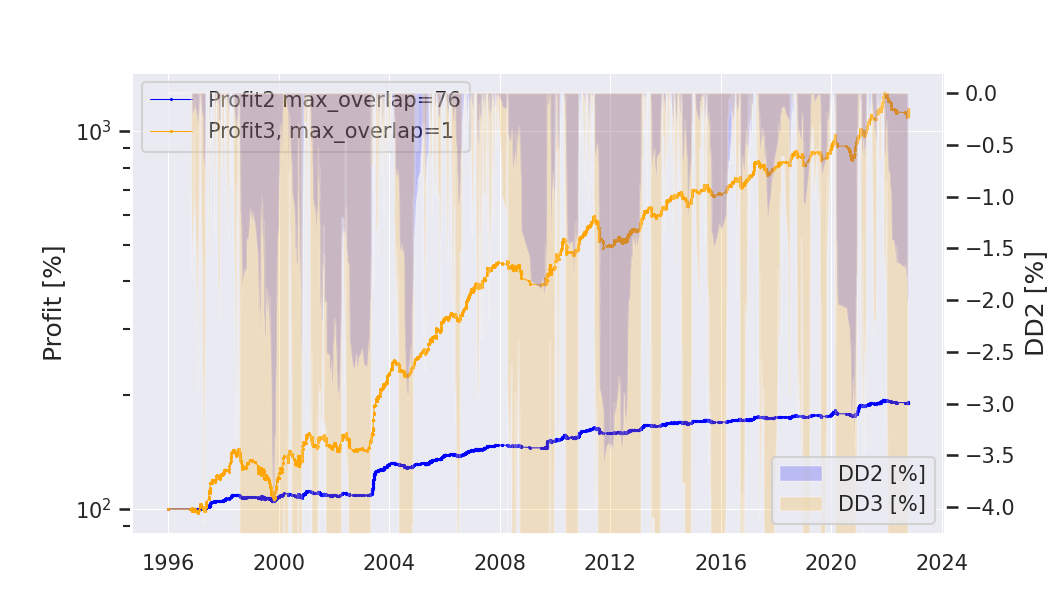

Result: Profit1: mit overlap=1 pro Symbol; Profit2: mit tatsaechlichem overlap gerechnet; Profit3: mit overlap=1 pro Symbol gerechnet

|

|

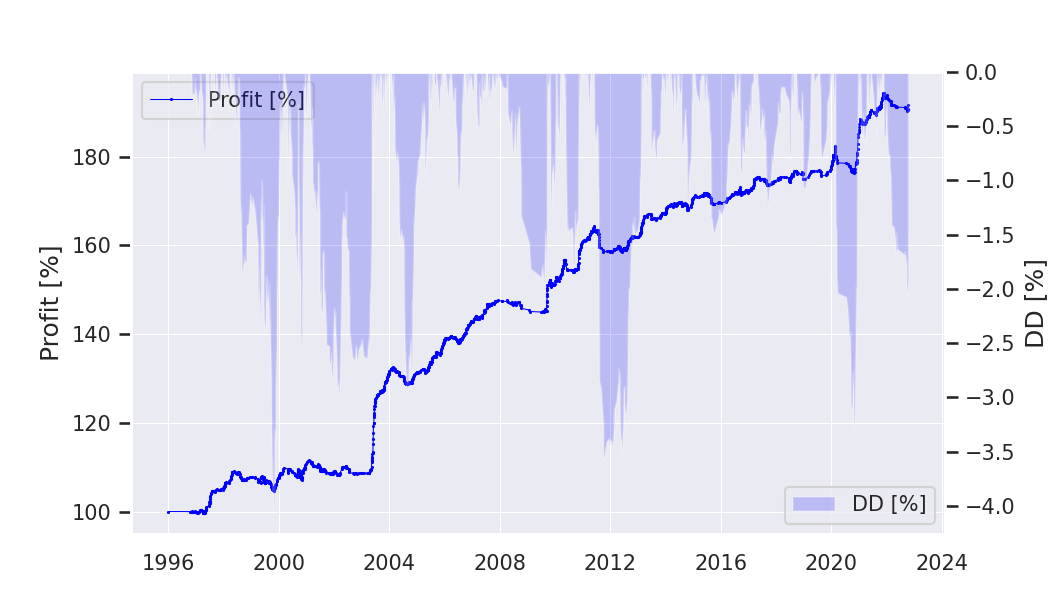

Equity from all_trades (profit2) |

Equity from all_trades (profit2 und profit1) |

Equity from all_trades profit3 |

Equity from all_trades (profit2 und profit3, log) |

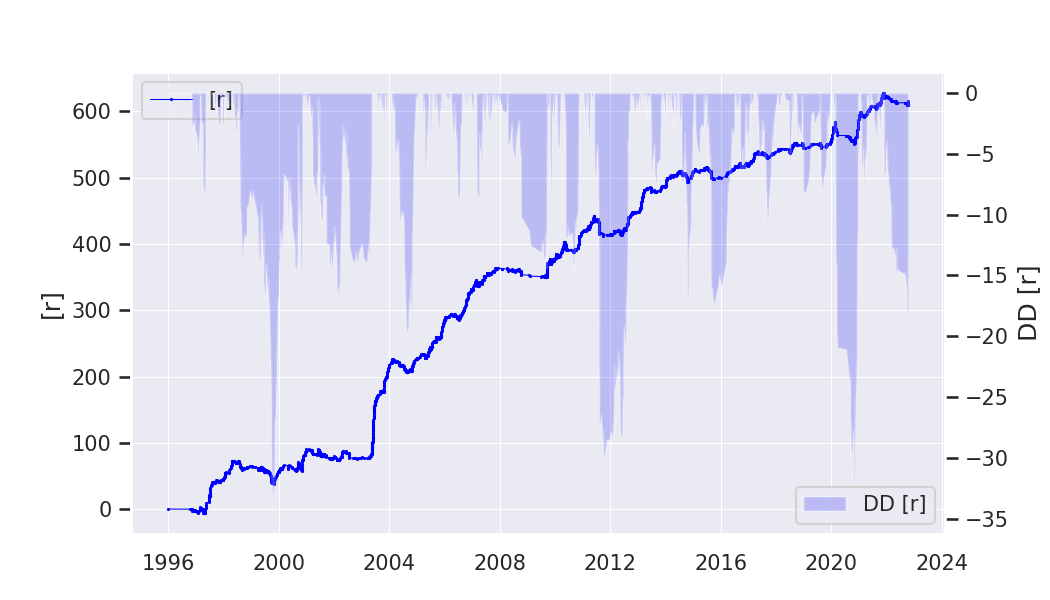

Equity r |

Equity Kurven

Equity Kurven pro Symbol

Equity Kurven pro Strategie

alle Dateien