|

|

|

External Signals:False

Standardfilter: False

|

filter all_trades: |

Bewertung nach 5,10,20,40,60 Tagen (es werden alles Signale verwendet):

| Timestop | count | count per year |

max pos |

return p |

return p day |

return p plus count |

return p minus count |

return p plus |

return p minus |

return r plus |

return r minus |

pf p |

pf r |

tq | return r |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1.0 | 1874.0 | 71.97 | 39.0 | 0.05 | 0.05 | 936.0 | 901.0 | 1271.8967288865665 | -1178.7946224119319 | 145.2934437058991 | -126.05653818826909 | 1.079 | 1.153 | 50.95 | 0.0103 |

| 2.0 | 1874.0 | 71.97 | 39.0 | 0.247 | 0.124 | 1011.0 | 842.0 | 1931.7928885101421 | -1468.0319648126533 | 223.96941321259328 | -163.4194482038261 | 1.316 | 1.371 | 54.56 | 0.0323 |

| 3.0 | 1874.0 | 71.97 | 39.0 | 0.298 | 0.099 | 1012.0 | 848.0 | 2449.4404305561675 | -1890.9019146376372 | 281.315682275981 | -212.49140991308738 | 1.295 | 1.324 | 54.41 | 0.0367 |

| 4.0 | 1874.0 | 71.97 | 39.0 | 0.338 | 0.084 | 1041.0 | 822.0 | 2805.539936924316 | -2172.858273587689 | 322.11897418605366 | -248.9989154017803 | 1.291 | 1.294 | 55.88 | 0.039 |

| 5.0 | 1874.0 | 71.97 | 39.0 | 0.353 | 0.071 | 1011.0 | 847.0 | 3126.554981776665 | -2464.2135189553287 | 364.9444810444936 | -285.3031169411506 | 1.269 | 1.279 | 54.41 | 0.0425 |

| 7.0 | 1874.0 | 71.97 | 39.0 | 0.439 | 0.063 | 1040.0 | 825.0 | 3705.6642876402257 | -2882.8188800683993 | 430.883933919875 | -331.44541688419315 | 1.285 | 1.3 | 55.76 | 0.0531 |

| 10.0 | 1874.0 | 71.97 | 39.0 | 0.684 | 0.068 | 1067.0 | 797.0 | 4644.485850550402 | -3363.6451686115633 | 537.1550576202835 | -393.6989260287678 | 1.381 | 1.364 | 57.24 | 0.0766 |

| 15.0 | 1874.0 | 71.97 | 39.0 | 1.11 | 0.074 | 1097.0 | 767.0 | 6199.437456794621 | -4122.443497001773 | 718.1274300803191 | -481.7736584885351 | 1.504 | 1.491 | 58.85 | 0.1263 |

| 20.0 | 1874.0 | 71.97 | 39.0 | 1.391 | 0.07 | 1112.0 | 748.0 | 7314.3955253351905 | -4713.649507767966 | 853.1530205606923 | -556.6582977038106 | 1.552 | 1.533 | 59.78 | 0.1586 |

| 30.0 | 1874.0 | 71.97 | 39.0 | 1.919 | 0.064 | 1112.0 | 747.0 | 9237.790605688117 | -5657.313745344861 | 1068.7230982276421 | -653.2855059773734 | 1.633 | 1.636 | 59.82 | 0.2226 |

| 50.0 | 1874.0 | 71.97 | 39.0 | 3.221 | 0.064 | 1144.0 | 717.0 | 12840.087234938397 | -6842.957350238357 | 1490.8630087977417 | -776.3829055253937 | 1.876 | 1.92 | 61.47 | 0.3837 |

| 100.0 | 1874.0 | 71.97 | 39.0 | 5.308 | 0.053 | 1160.0 | 687.0 | 19383.54519326341 | -9563.313227955758 | 2281.5734835845856 | -1051.4863986120474 | 2.027 | 2.17 | 62.8 | 0.6649 |

| 200.0 | 1874.0 | 71.97 | 39.0 | 9.272 | 0.046 | 1186.0 | 631.0 | 28869.783632663486 | -12004.453289457926 | 3427.0035042244535 | -1309.6052858574226 | 2.405 | 2.617 | 65.27 | 1.164 |

entries same day:

| anzahl | |

|---|---|

| anzahl_entries_tag | |

| 2 | 238 |

| 3 | 52 |

| 4 | 13 |

| 5 | 4 |

| 6 | 2 |

| 7 | 2 |

| 8 | 1 |

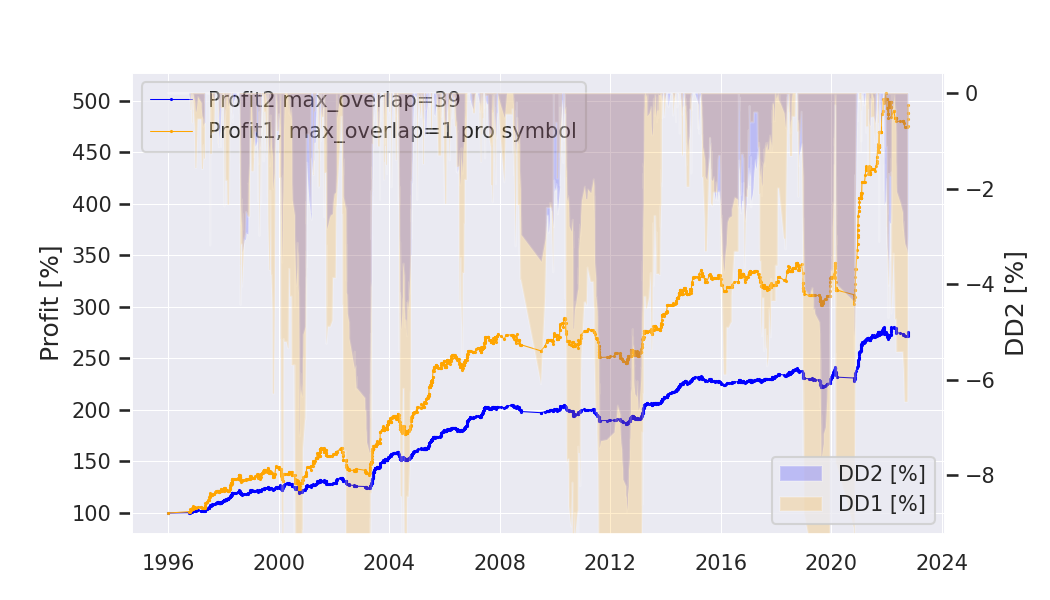

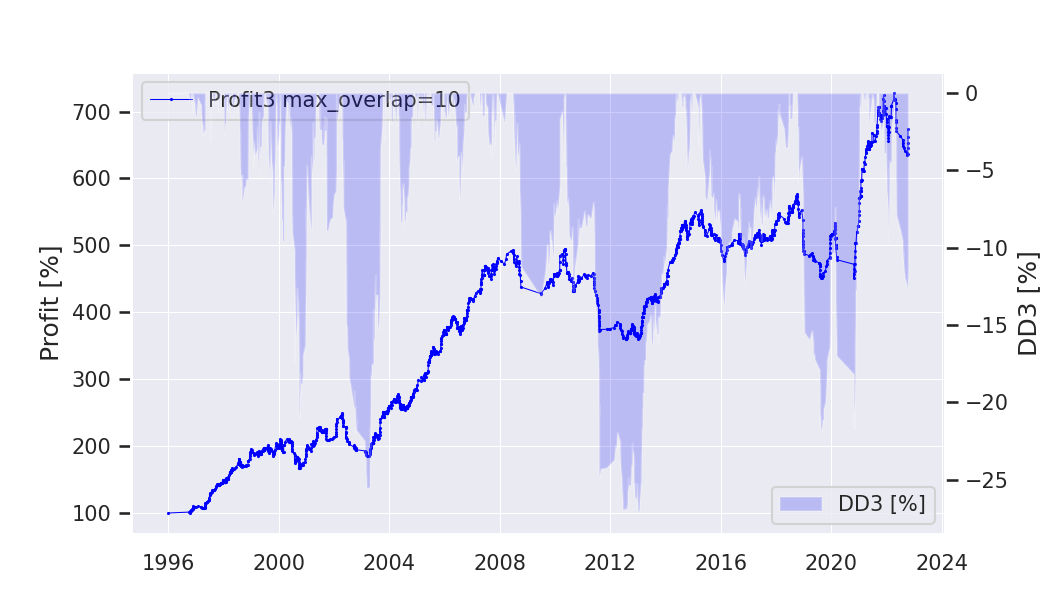

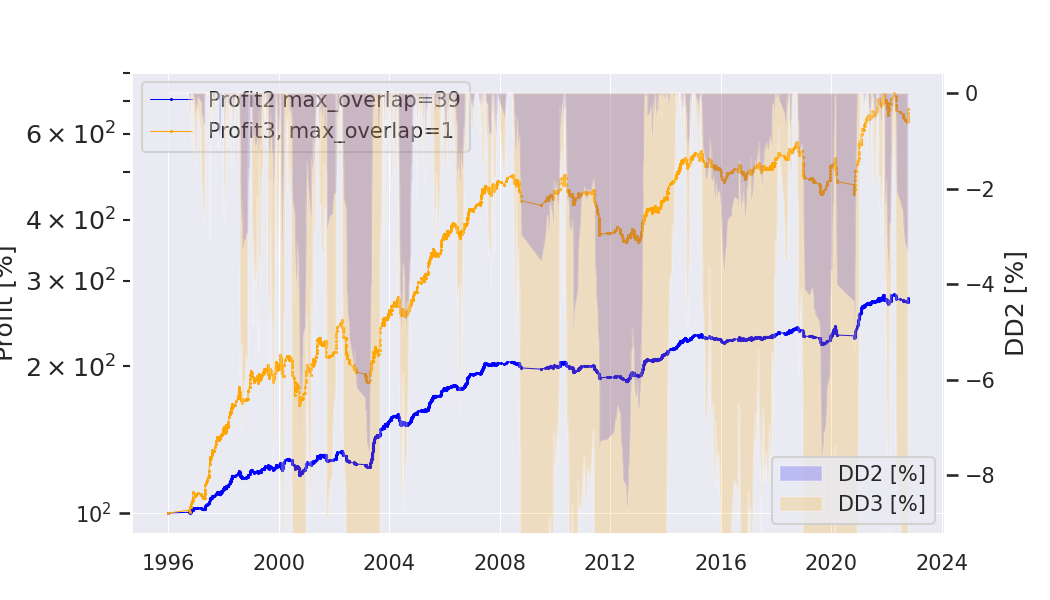

Result: Profit1: mit overlap=1 pro Symbol; Profit2: mit tatsaechlichem overlap gerechnet; Profit3: mit overlap=1 pro Symbol gerechnet

|

|

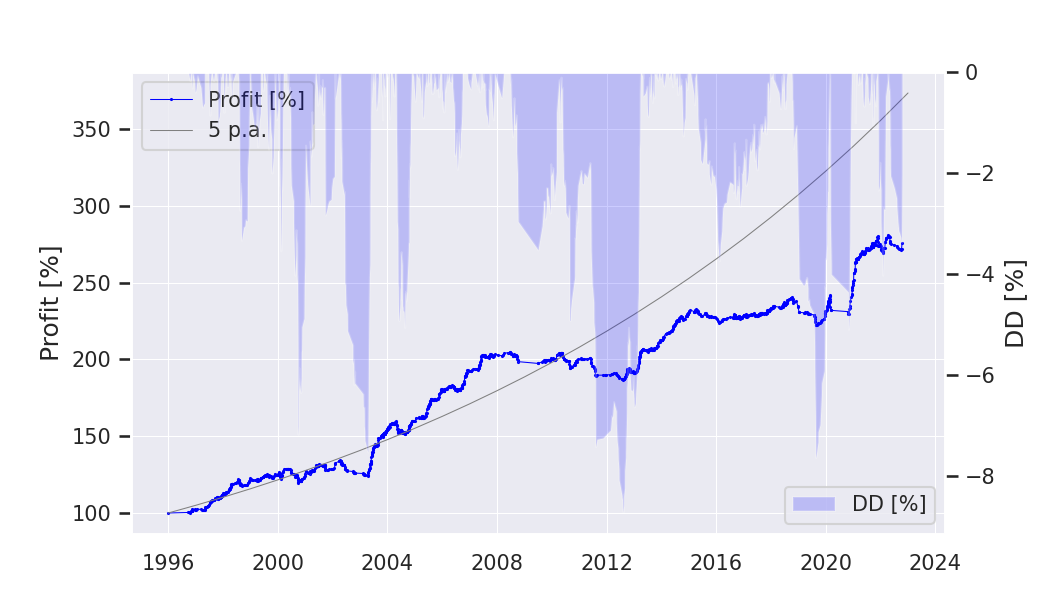

Equity from all_trades (profit2) |

Equity from all_trades (profit2 und profit1) |

Equity from all_trades profit3 |

Equity from all_trades (profit2 und profit3, log) |

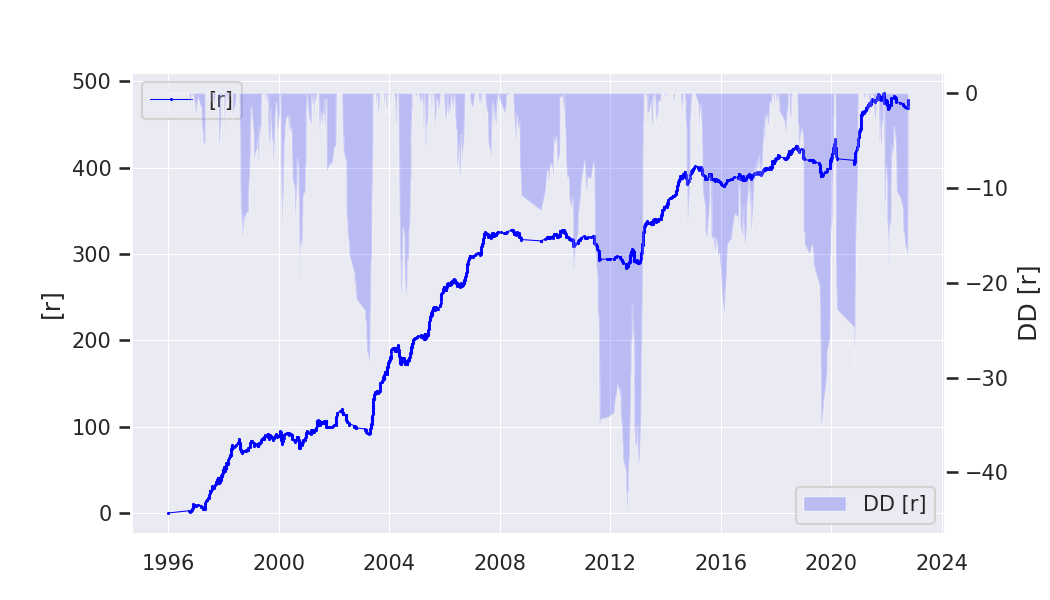

Equity r |

Equity Kurven

Equity Kurven pro Symbol

Equity Kurven pro Strategie

alle Dateien