|

|

|

External Signals:False

Standardfilter: False

|

filter all_trades: |

Bewertung nach 5,10,20,40,60 Tagen (es werden alles Signale verwendet):

| Timestop | count | count per year |

max pos |

return p |

return p day |

return p plus count |

return p minus count |

return p plus |

return p minus |

return r plus |

return r minus |

pf p |

pf r |

tq | return r |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1.0 | 1137.0 | 43.61 | 25.0 | 0.074 | 0.074 | 588.0 | 531.0 | 772.4748371723082 | -687.859470993574 | 99.92343972495009 | -90.08546286134552 | 1.123 | 1.109 | 52.55 | 0.0087 |

| 2.0 | 1137.0 | 43.61 | 25.0 | 0.259 | 0.129 | 619.0 | 507.0 | 1197.5446144241394 | -903.32109704491 | 155.19508679098527 | -118.14368231279613 | 1.326 | 1.314 | 54.97 | 0.0326 |

| 3.0 | 1137.0 | 43.61 | 25.0 | 0.371 | 0.124 | 621.0 | 500.0 | 1549.8744545156069 | -1128.4167928561449 | 200.50457241943369 | -150.66632315523765 | 1.373 | 1.331 | 55.4 | 0.0438 |

| 4.0 | 1137.0 | 43.61 | 25.0 | 0.362 | 0.091 | 615.0 | 512.0 | 1732.1012222914615 | -1320.2814119129632 | 229.6517364112078 | -175.9417990923595 | 1.312 | 1.305 | 54.57 | 0.0472 |

| 5.0 | 1137.0 | 43.61 | 25.0 | 0.407 | 0.081 | 636.0 | 494.0 | 1948.1677796480471 | -1484.928681314936 | 258.74011938258633 | -198.50997161086144 | 1.312 | 1.303 | 56.28 | 0.053 |

| 7.0 | 1137.0 | 43.61 | 25.0 | 0.591 | 0.084 | 638.0 | 487.0 | 2365.1704873582994 | -1692.6696823121058 | 314.53283602943736 | -228.50929579267873 | 1.397 | 1.376 | 56.71 | 0.0757 |

| 10.0 | 1137.0 | 43.61 | 25.0 | 0.691 | 0.069 | 657.0 | 474.0 | 2887.9862499546007 | -2102.0263766817693 | 379.76057535291835 | -285.50289874499856 | 1.374 | 1.33 | 58.09 | 0.0829 |

| 15.0 | 1137.0 | 43.61 | 25.0 | 1.005 | 0.067 | 654.0 | 479.0 | 3705.5881547110853 | -2563.8927960493147 | 484.8254946051359 | -355.27373580458175 | 1.445 | 1.365 | 57.72 | 0.114 |

| 20.0 | 1137.0 | 43.61 | 25.0 | 1.625 | 0.081 | 672.0 | 460.0 | 4594.2933366055295 | -2750.123382155097 | 595.588478399726 | -373.4799899112792 | 1.671 | 1.595 | 59.36 | 0.1957 |

| 30.0 | 1137.0 | 43.61 | 25.0 | 2.253 | 0.075 | 667.0 | 465.0 | 5715.368527296408 | -3160.3648997246546 | 726.0002273015284 | -426.5973852903187 | 1.808 | 1.702 | 58.92 | 0.264 |

| 50.0 | 1137.0 | 43.61 | 25.0 | 3.026 | 0.061 | 704.0 | 424.0 | 7226.508775167866 | -3810.4469861416374 | 945.5711054186947 | -497.39742532530283 | 1.896 | 1.901 | 62.41 | 0.397 |

| 100.0 | 1137.0 | 43.61 | 25.0 | 4.945 | 0.049 | 701.0 | 416.0 | 11036.072279354246 | -5507.708997551671 | 1459.503105853763 | -708.2911869577504 | 2.004 | 2.061 | 62.76 | 0.6719 |

| 200.0 | 1137.0 | 43.61 | 25.0 | 6.622 | 0.033 | 655.0 | 444.0 | 15749.63232411233 | -8451.896966311193 | 2140.507468168763 | -1045.6375822985174 | 1.863 | 2.047 | 59.6 | 0.9935 |

entries same day:

| anzahl | |

|---|---|

| anzahl_entries_tag | |

| 2 | 118 |

| 3 | 21 |

| 4 | 8 |

| 5 | 2 |

| 6 | 2 |

| 8 | 1 |

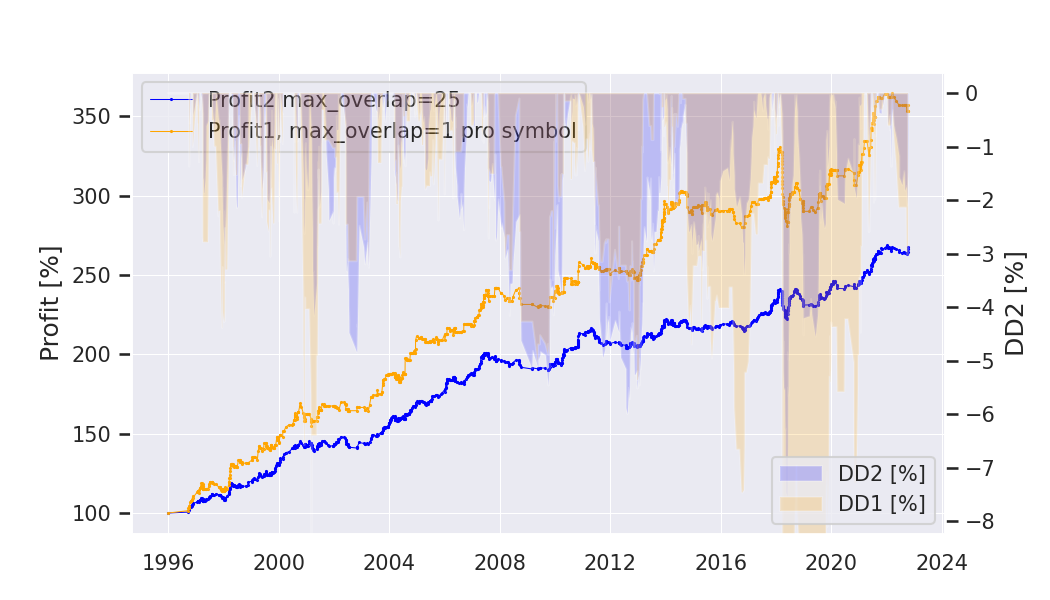

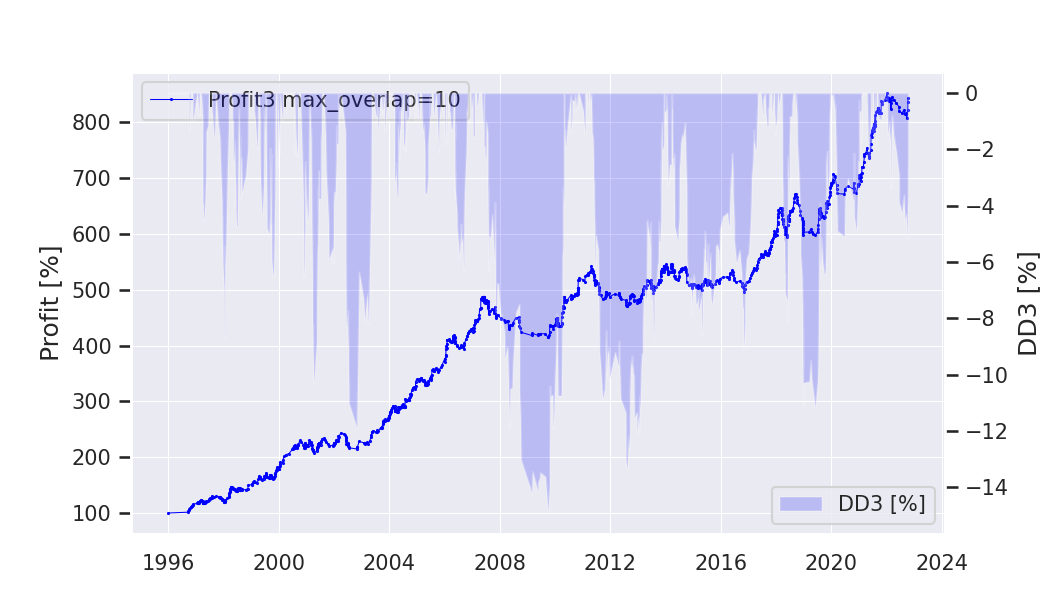

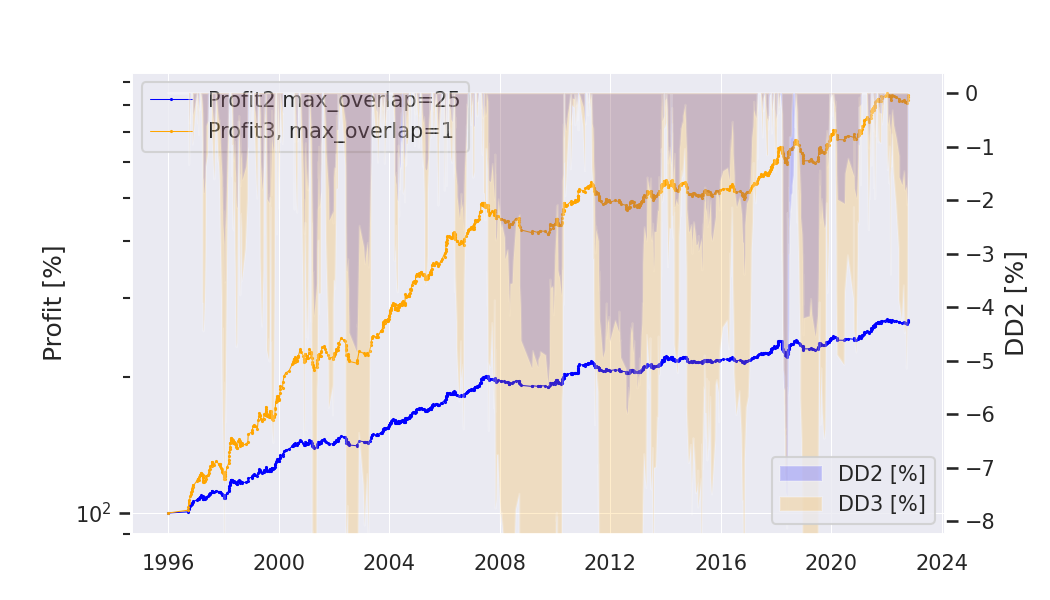

Result: Profit1: mit overlap=1 pro Symbol; Profit2: mit tatsaechlichem overlap gerechnet; Profit3: mit overlap=1 pro Symbol gerechnet

|

|

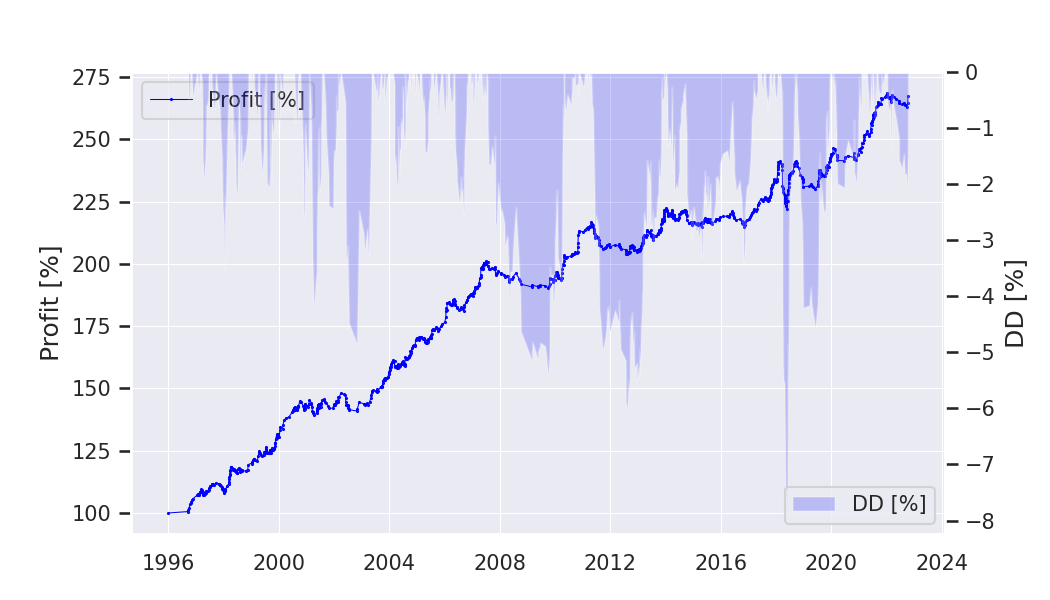

Equity from all_trades (profit2) |

Equity from all_trades (profit2 und profit1) |

Equity from all_trades profit3 |

Equity from all_trades (profit2 und profit3, log) |

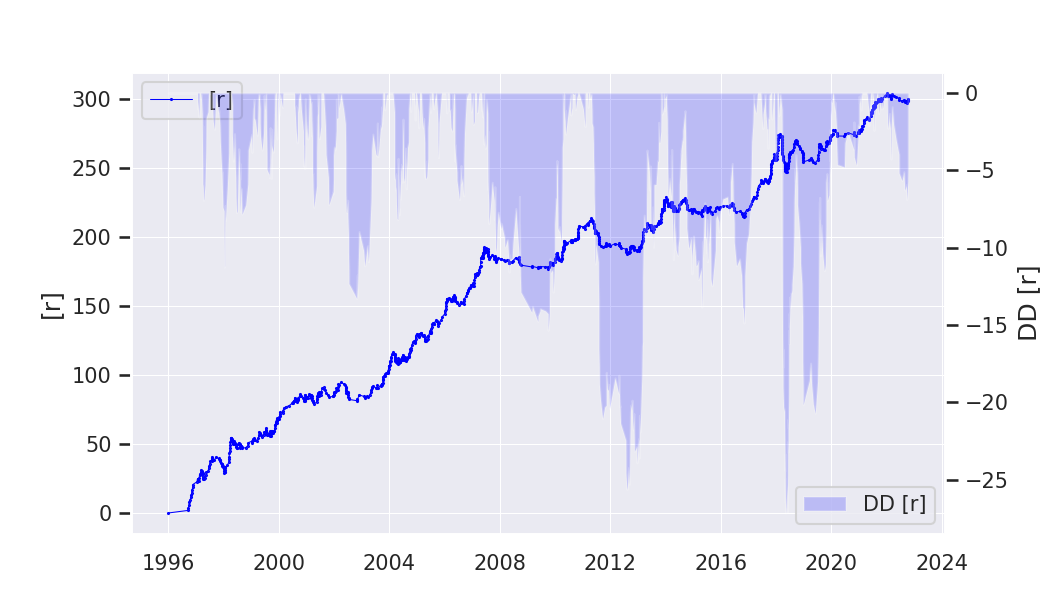

Equity r |

Equity Kurven

Equity Kurven pro Symbol

Equity Kurven pro Strategie

alle Dateien